Greater efficiency, less risk — the right tax software is key

It’s time to stop wrestling with cumbersome spreadsheets and manually debugging your calculations. Bloomberg Tax has best-in-class software solutions that modernize your tax process, from data collection to calculations.

Bloomberg Tax Workpapers

Automatic data transformation and time-saving tax-specific functions give you complete control of your workpapers. Revamp your manual processes by automating data prep, strengthening controls, and streamlining tax calculations – all in one solution.

Take a moment to learn how Bloomberg Tax Provision can work for you and your company. Video length: 1:37

Bloomberg Tax Provision

The most powerful ASC 740 calculation engine on the market, our software solves the technical and process issues involved in calculating your income tax provision – taking manual risks out of the equation.

Bloomberg Tax Fixed Assets

Reduce risk, efficiently manage assets, and accurately calculate depreciation with built-in up-to-date tax laws, flexibility, and controls – from construction and purchase through retirement. Automate your fixed assets workflow, so you can focus on your organization’s strategic outlook.

Enhance your income tax planning capabilities

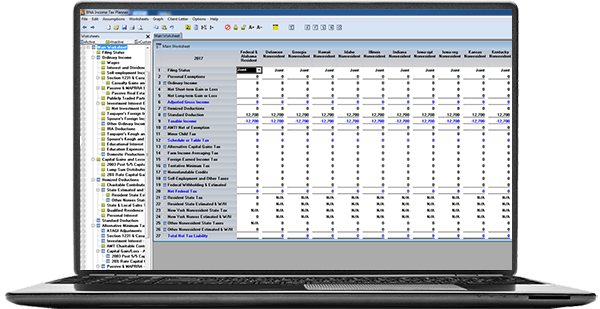

Income Tax Planner

Easily create and compare multiple scenarios, minimize clients’ tax liabilities, and present the most advantageous strategies. Offer more complex, value-added tax planning services to attract and retain clients.

Confidently manage every corporate tax scenario

Corporate Tax Analyzer

Gain control, accuracy, and visibility into every aspect of corporate income tax management and planning. This corporate tax audit and planning software automates and manages complex, multiyear corporate income tax attributes such as carrybacks and carryovers.

Ready to start minimizing risk and maximizing efficiency?

Set up a product demonstration today.